Selecting between OFX and Wise for sending funds abroad could potentially save you significant amounts in fees and exchange rate markups. That much is clear. But while they purport a similar raison d’être, which one truly fulfills its promise? The personalized service of a currency specialist that OFX offers might appeal to some; the straightforward and user-friendly Wise might have others’ hearts. For the purposes of this piece, however, let’s consider these platforms purely from the perspective of cost-effective money transfers.

After poring over G2 reviews, Reddit threads, and loads of direct user experiences, I feel like I have a pretty good bead on what these two money transfer titans are really like from a usability and experience standpoint. Here’s what you need to know about them.

- International Money Transfer Showdown: OFX vs Wise Overview

- Cross Border Payments Made Simple: How Each Platform Works

- Best International Money Transfer Rates: Fee Comparison

- OFX or Wise to transfer Money Internationally: Features Comparison

- Ofx vs Wise to send money abroad: Real User Experiences and Reviews

- Overseas Money Transfer Security: Which Platform is Safer?

- International Money Transfer Verdict: OFX vs Wise Winner

International Money Transfer Showdown: OFX vs Wise Overview

OFX and Wise (TransferWise) are two international money transfer companies. OFX is an alternative to banks and focuses on service and rates for large transfers. Wise (formerly TransferWise) is a platform that offers money transfer services at midmarket rates similar to those found on the Reuters FX platform. They give the customer the same rate that TransferWise gets when changing money from one currency to another at an international bank. Wise is renowned for its transparency and low costs.

Wise Speedy Figures:

- 2011: Year of Founding (then known as TransferWise)

- Rating on G2: 3.9/5 (count of 89 reviews)

- Rating on Trustpilot: 4.3/5 (from no less than 260,000 reviews)

- 160+ countries available

Overview of OFX:

- Established: 1998

- Rating on G2: 4.1/5 (13 reviews)

- Rating on Trustpilot: 4.4/5 (more than 10,000 reviews)

- Operating in: over 190 countries

What’s the basic distinction? Wise employs the actual exchange rate—known as the mid-market rate—and levies clear and direct fees. OFX applies a markup to the rate but tells you about it and promises an overall competitive rate for most transactions.

Cross Border Payments Made Simple: How Each Platform Works

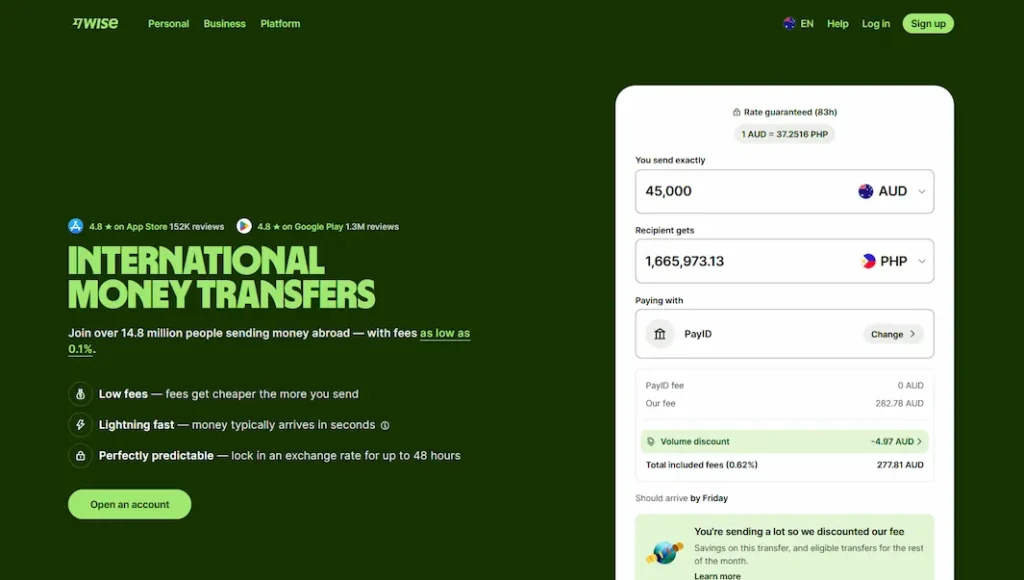

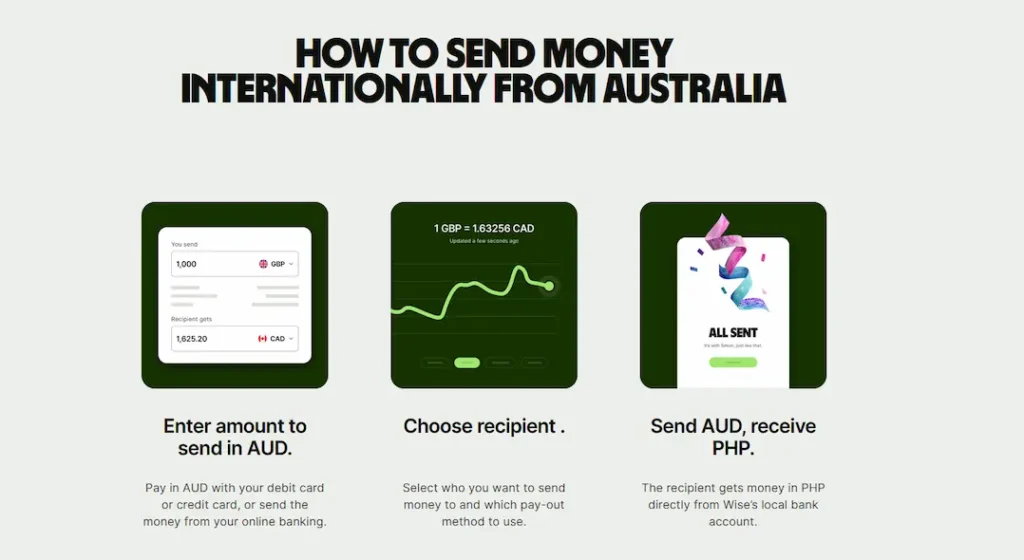

Wise’s Transparent Model

Wise made a profound change in the way we interact with money when we send it overseas. It introduced a new level of transparency that our old-school banks simply don’t offer. When you send money with Wise, you’re using a tool that’s fundamentally different: you send at the mid-market rate (the rate you’d find on Google), not an inflated one as the banks offer, and you pay a clear, percentage-based fee. No hidden markups, no surprises.

For a $10,000 USD to EUR transfer, Wise demonstrates:

- Exchange rate: The actual mid-market rate

- Fee: 0.43% ($43)

- Total cost: $43

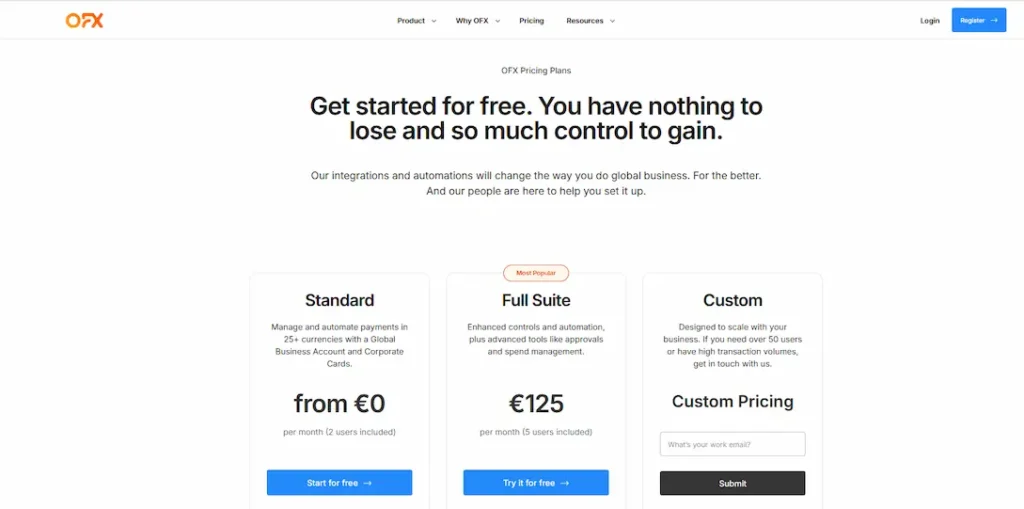

OFX’s Relationship-Based Approach

OFX functions in a more conventional foreign exchange brokerage capacity. They establish direct relationships with their customers and are able to afford their frequent and/or high-volume transfer customers advantageous exchange rates. The ‘margin’—which is the built-in profit to the company above and beyond the cost of acquiring the money’s new currency—looks bad to a superficial comparison, but often works out in the customer’s favor for actual large or frequent transactions.

A Redditor from the subreddit r/PersonalFinanceCanada recounted their story:

“I receive more favorable rates from OFX, yet those too result in even more favorable rates when one calls them and negotiates.”

Best International Money Transfer Rates: Fee Comparison

This is the part that really gets interesting. Although conventional wisdom would have you believe that Wise is always cheaper than the banks, a series of real-world tests tell a different story.

Small Payments (Up to $10,000)

Wise is usually the better choice for transferring smaller amounts of money overseas:

- Wise: 0.43% – 0.65% fee + mid-market rate

- OFX: $15 fee + rate markup (usually 0.5-1.5%)

Big Transfers ($100,000+)

An examination of Reddit’s r/PersonalFinanceCanada compared the transfer of 100,000 Canadian dollars to euros:

- OFX: Recipient gets EUR 68,530.00 (rate 0.6853)

- Wise: Recipient gets EUR 68,828.27 (rate 0.691873)

Wise came out ahead even for large sums. Nevertheless, that does not change the fact — at least according to a number of personal experiences — that OFX delivers better-negotiated rates.

According to one user on the r/AusFinance subreddit:

“TransferWise makes money from the fees it charges, not the exchange rate. Customers’ funds are exchanged at the mid-market rate. OFX and banks make money from the exchange rate.”

The Reality Check

The UK arm of Forbes Advisor says that OFX has a wonderful Trustpilot rating of 4.4 stars and that its users offer consistent praise of the firm for its transparency. The big difference between the two companies? OFX’s rates get dramatically better once you pick up the phone and connect with one of their representatives. So if you need anything like $50,000 or more, you’d be wise to negotiate.

OFX or Wise to transfer Money Internationally: Features Comparison

Speed: Wise Takes the Lead

Transfer speed varies dramatically between the platforms:

Wise Speed:

- Effortless delivery to certain large currencies within a single day

- Rapid remittances that sometimes take only ten minutes

- A platform whose transactions clear, on average, in one to two days

A Reddit user from the r/PersonalFinanceCanada subreddit shared:

“The previous transfer of $9,000 to the European Union took about 10 minutes.”

OFX Speed:

- Major currencies take 1–2 business days

- Exotic ones may take up to 5

- Phone verifications might add some extra delay

Transfer Limits

Wise Constraints:

- The least Wise can send is $1

- The most you can send at once is variable, depending on the target country (often $1.6M per transfer)

- Some countries have lower limits (e.g., $5K USD to KRW)

OFX Limits:

- Minimum amount: $250

- For most countries, there is no maximum amount

- Better suited for transferring very large amounts of money

User Experience: The App Battle

Wise clearly favors a style that puts priority on the mobile user. The app is frequently and favorably described as ‘intuitive’ and ‘easy to use.’ By contrast, the OFX app is considered ‘more traditional’ and involves ‘more manual input.’ It may be functional, but it doesn’t give the user quite the same sense of instant feedback and ‘real-time tracking’ that the Wise app delivers.

A user from the Canadian personal finance subreddit offers this opinion:

“Transfer rates achieve a speed of light-like quality… The absence of bricks and mortar means that all Wise do is built into the digital environment, which makes for a number of brilliant decisions in a good app and web interface that very few competitors can match.”

Ofx vs Wise to send money abroad: Real User Experiences and Reviews

The Wise Experience

G2 commentators consistently emphasize the clear and rapid nature of Wise. The platform boasts a rating of 3.9 out of 5 stars from 89 reviews on G2. Users seem to like exactly that clear and rapid nature, especially when compared to other, more labyrinthine solutions.

Common Wise praise:

- “Its fees are the lowest. Believe me, I’ve sampled a lot of services.”

- “Transfers are incredibly simple and lightning-fast; money gets there in no time at all.”

- “Most trustful, fastest, easiest to use and cheapest service”

The OFX Experience

Users give OFX a 4.1 out of 5 rating on G2. This comes from fewer reviews, but the majority are satisfied. They feel like they’re dealing with something closer to a bank than a tech company. OFX is best for the customer who wants their service to feel personal and works well for transferring large amounts of money reliably.

A Reddit user from r/AusFinance shared:

“I have made several transactions using OFX, each worth between 5 and 6 figures. The system never fails.”

However, not all experiences are positive. Another r/AusFinance user said:

“Choosing Wise over OFX was smart in my book. I experienced slowdowns and a funds transfer rejection with OFX, but when I used Wise to transfer money to the exact same set of overseas account details, everything went through.”

The Reddit Verdict

Scanning through multiple Reddit discussions, a clear pattern emerges:

- Wise: a top option for clear reasons of transparency, speed, and competitive costs

- OFX: a go-to for businesses and users who need personalized service and negotiate rates

From r/expats:

“In the past I used OFX, but now I use Wise because it seems to afford the best rates and the most transparency regarding what money is really going to cost.”

Overseas Money Transfer Security: Which Platform is Safer?

The platforms are both under strict regulation, but they differ in how they ensure security.

Wise Security Features:

- Supervised by the UK’s FCA and the US’s FinCEN

- Customer funds protected by segregated bank accounts

- Standard two-factor authentication

- Real-time fraud monitoring system

OFX Security Features:

- Regulated by ASIC in Australia and FCA in the UK

- 25+ years in business since 1998

- Personal account managers for verification

- Traditional banking-style security protocols

The Trust Factor

Wise is very upfront about its security systems and guarantees. It clearly explains what is protecting your money. On the flip side, OFX has the confidence of a longer track record, having been in business since 1998. However, their website doesn’t prominently feature security communications as much as Wise does.

Neither platform has ever lost customer funds, and both operate under regulatory conditions that require them to maintain customer accounts completely separate from the company’s own funds.

International Money Transfer Verdict: OFX vs Wise Winner

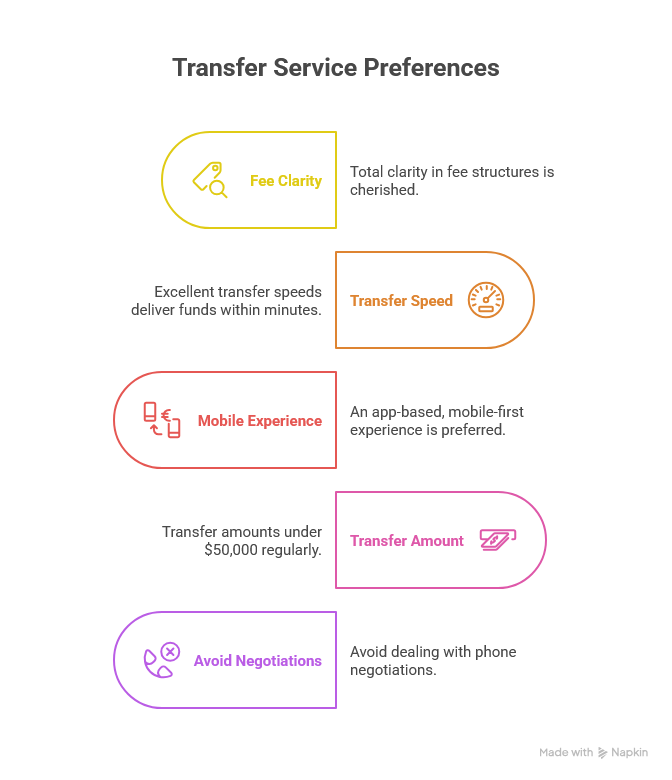

Choose Wise if you:

- Cherish total clarity in fee structures

- Require excellent transfer speeds that can deliver funds within minutes

- Prefer an app-based, mobile-first experience

- Transfer amounts under $50,000 regularly

- Would rather avoid dealing with phone negotiations

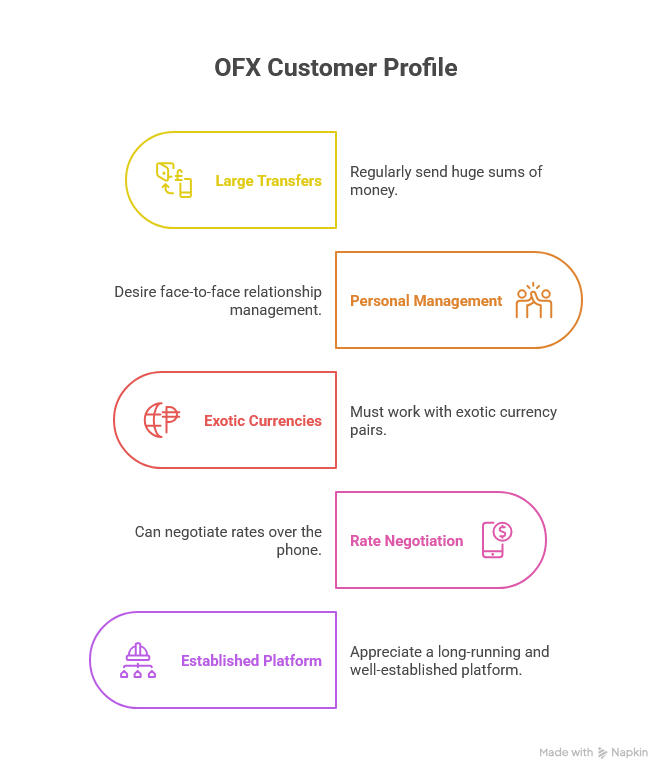

Choose OFX if you:

- Send huge sums ($100,000+) regularly

- Want face-to-face relationship management

- Must work with exotic currency pairs

- Can negotiate rates over the phone

- Appreciate a long-running and well-established platform

The Bottom Line

The majority of users find that Wise provides the most optimum mixture of speed, clarity, and cost-effectiveness. Its mobile-first mentality and no-fuss fee system makes it the platform best suited for regular international transfers.

Nonetheless, OFX ought not to be dismissed. For high-value transfers or users who prefer personalized service, OFX’s relationship-based model can deliver superior value – you just need to be willing to pick up the phone and negotiate.

As one experienced Reddit user from r/PersonalFinanceCanada concluded:

“I have not encountered any transfer service that costs less than Wise on any amount. Perhaps there are alternatives if you are working with sums in the hundreds of thousands?”