Picking the right cryptocurrency exchange can make or break your entire trading journey. With thousands of platforms fighting for your attention, the Coinbase vs Uphold debate has become one of the hottest topics in crypto circles. Both exchanges serve millions of users worldwide, but they couldn’t be more different in their approach to trading, fees, and overall user experience.

Whether you’re just getting started and need a solid coinbase alternative or you’re a seasoned trader hunting for the perfect platform, this deep-dive comparison will give you everything you need to make the right choice. Let’s break down what each exchange brings to the table and figure out which one deserves your hard-earned money.

- Coinbase vs Uphold: Quick Comparison Table

- Crypto Exchange Fees: Coinbase vs Uphold Cost Breakdown

- Trading Features: Which Platform Offers Better Crypto Trading Tools?

- Security and Regulation: How Both Exchanges Protect Your Assets

- Supported Cryptocurrencies: Coinbase vs Uphold Asset Variety

- User Interface and Mobile Apps: Ease of Use Comparison

- Customer Support: Real User Experiences and Response Times

- Final Verdict: Coinbase vs Uphold – Which Should You Choose?

Coinbase vs Uphold: Quick Comparison Table

| Feature | Coinbase | Uphold |

| Overall G2 Rating | 3.8/5 (121 reviews) | 4.1/5 (86 reviews) |

| Trading Fees | 0.05% – 0.60% (Advanced) | Up to 2.95% |

| Withdrawal Fees | Up to 3% | Up to 1.75% |

| Supported Cryptos | 400+ cryptocurrencies | 300+ cryptocurrencies |

| Active Users | 8.8 million | 10 million |

| Founded | 2012 | 2013 |

| Best For | Beginners & Advanced Users | Multi-asset trading |

| Security Features | FDIC insured, cold storage | Full reserves, regulatory compliance |

| Customer Support | Email, phone, chat | Email, FAQ (no live support) |

Coinbase Alternative: Why Traders Are Considering Uphold

The hunt for a reliable coinbase alternative has brought many traders to Uphold’s doorstep, and honestly, there are some solid reasons why. While Coinbase sits pretty at the top of the U.S. market with its polished interface and rock-solid regulatory standing, Uphold is playing a completely different game that’s catching people’s attention.

Here’s something interesting: Uphold actually scores 4.1 out of 5 on G2 compared to Coinbase’s 3.8 out of 5. That suggests users are finding Uphold’s experience just a bit more satisfying overall. One G2 reviewer put it simply:

“Overall, I have found Uphold to be a reliable and convenient exchange that I would highly recommend to others.”

What’s driving people to give Uphold a shot:

- It’s not just crypto: Uphold lets you trade precious metals, stocks, and regular currencies alongside your crypto

- They’re quick on new tokens: Often the first to list hot new cryptocurrencies while bigger exchanges are still thinking about it

- Full transparency: They actually show you their reserves in real-time – no hiding behind corporate speak

- Global reach: Available in 180+ countries when others are more restrictive

Reddit user zeytun11 from r/XRP shared something that really highlights Uphold’s approach:

“Uphold was one of the only exchanges that offered XRP back when most of them decided to delist it amongst all the SEC drama. I initially bought on Uphold when I first got into it a few years ago.”

That right there shows you Uphold’s biggest strength: they’ll stick with assets that others drop when things get legally messy.

Uphold Review: Features, Fees, and User Experience

Uphold isn’t trying to be just another crypto exchange – they’re positioning themselves as your one-stop digital money platform. Whether that’s a good thing or not depends on what you’re looking for.

Platform Features

Trading Setup: Over 300 cryptocurrencies plus precious metals (gold, silver, platinum) and traditional assets. Their “anything-to-anything” trading is pretty slick – you can convert directly between any assets without jumping through hoops.

Mobile Experience: The app works, but it’s not winning any beauty contests. Some users complain about glitches and slower performance compared to the big players.

Learning Resources: Pretty bare bones compared to Coinbase. They’re clearly more focused on getting you trading than teaching you the ropes. They call it Cryptionary 🙂 It not only sounds fun, but it is also useful.

What Real Users Are Saying on Reddit

Reddit always gives you the unfiltered truth about these platforms:

The good stuff – User whalewolff was pretty direct:

“I use uphold for everything never had any issues and they don’t just delist coins if you know what I mean.”

The not-so-good – But BanksLoveMe_ had a different take:

“uphold is pretty expensive”

And That_Assignment_2967 shared their concerns:

“Ive heard some horror stories about Uphold. Not sure if it’s true… I’m moving to coin base.”

The support issue: Multiple users keep mentioning that Uphold’s lack of live customer support is a real pain, especially when you need help RIGHT NOW during a trade gone wrong.

Crypto Exchange Fees: Coinbase vs Uphold Cost Breakdown

This is where things get real for active traders. Fees can absolutely destroy your profits if you’re not careful, so let’s break down exactly what you’re looking at:

Coinbase Fee Structure

Trading Fees:

- Basic Coinbase: Up to 3.99% for credit/debit card buys (ouch)

- Coinbase Advanced: 0.05% – 0.60% maker/taker fees (much better)

- Volume discounts for heavy traders

Withdrawal Fees: Up to 3% depending on how and where you’re moving your money

The reality: Great for serious traders using the Advanced platform, brutal for casual users on basic.

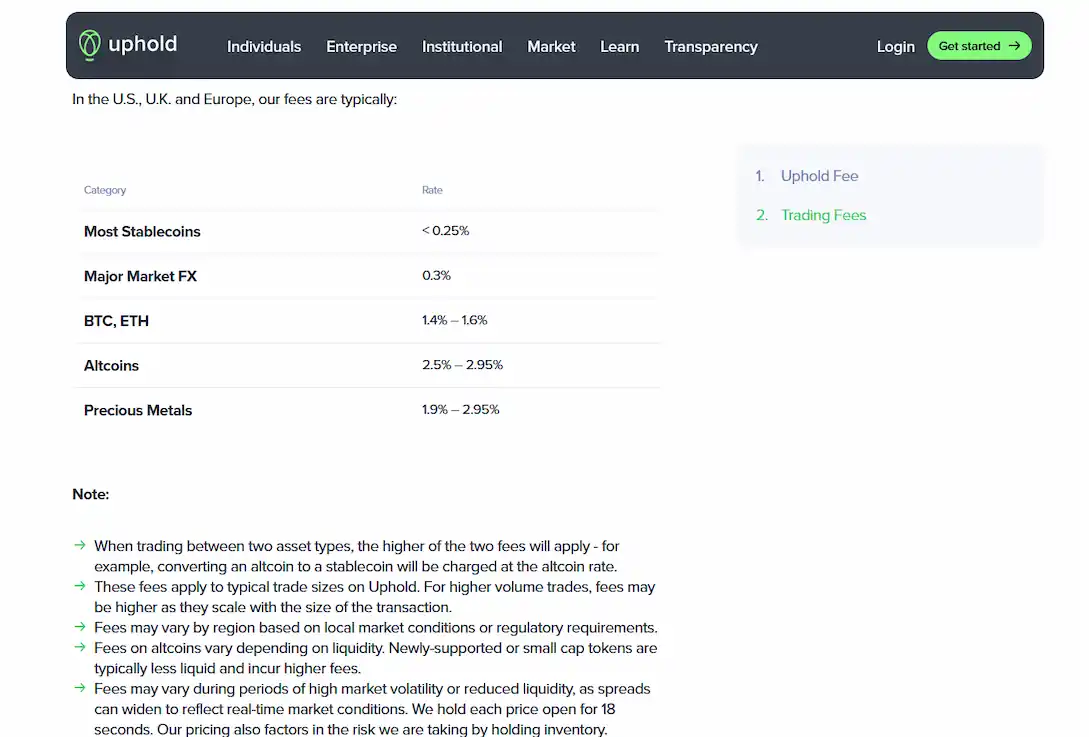

Uphold Fee Structure

Trading Fees: Up to 2.95% across all trading pairs Spread: Up to 2.65% on crypto purchases Withdrawal Fees: Up to 1.75% for crypto withdrawals

The reality: More predictable pricing, lower withdrawal costs, but higher overall trading expenses

What This Means in Real Money

Let’s say you want to buy $1,000 worth of Bitcoin:

- Coinbase Advanced: About $6 in fees (0.60%)

- Uphold: About $29.50 in fees (2.95%)

If you’re trading $10,000 monthly:

- Coinbase Advanced: ~$60 in trading fees

- Uphold: ~$295 in trading fees

One Reddit user from r/uphold shared:

“I did some comparing on prices of buying on uphold vs. coinbase, and it seemed like uphold was lower by a bit. Coinbase seems to be very [expensive].”

But they were probably comparing to basic Coinbase, not the Advanced version.

Trading Features: Which Platform Offers Better Crypto Trading Tools?

Coinbase Trading Arsenal

Coinbase Advanced (the platform formerly known as Coinbase Pro):

- Proper charting with technical indicators

- All the order types you need: market, limit, stop orders

- Portfolio tracking that actually makes sense

- API access for the algorithm crowd

- Dollar-cost averaging tools

Basic Coinbase:

- Dead simple buy/sell interface

- Price alerts

- Recurring purchases

- Educational content built right in

Uphold Trading Features

- Real-time “anything-to-anything” trading

- Basic charting (emphasis on basic)

- Price alerts

- Developer API access

- Multi-asset portfolio view

- Uphold Card for spending your crypto

For Serious Traders

If you’re really into trading, Coinbase Advanced absolutely crushes Uphold when it comes to sophisticated tools. Better charts, more order types, superior portfolio management – it’s not even close.

Uphold shines if you want simplicity and don’t need all the bells and whistles.

Security and Regulation: How Both Exchanges Protect Your Assets

Coinbase Security Setup

Regulatory Standing: Publicly traded (NASDAQ: COIN), regulated by multiple U.S. agencies Insurance: FDIC insured up to $250,000 for your USD deposits Storage: 95% of funds locked away in offline cold storage Security Features: Two-factor authentication, biometric login, device management

Track Record: Generally solid with few major security incidents

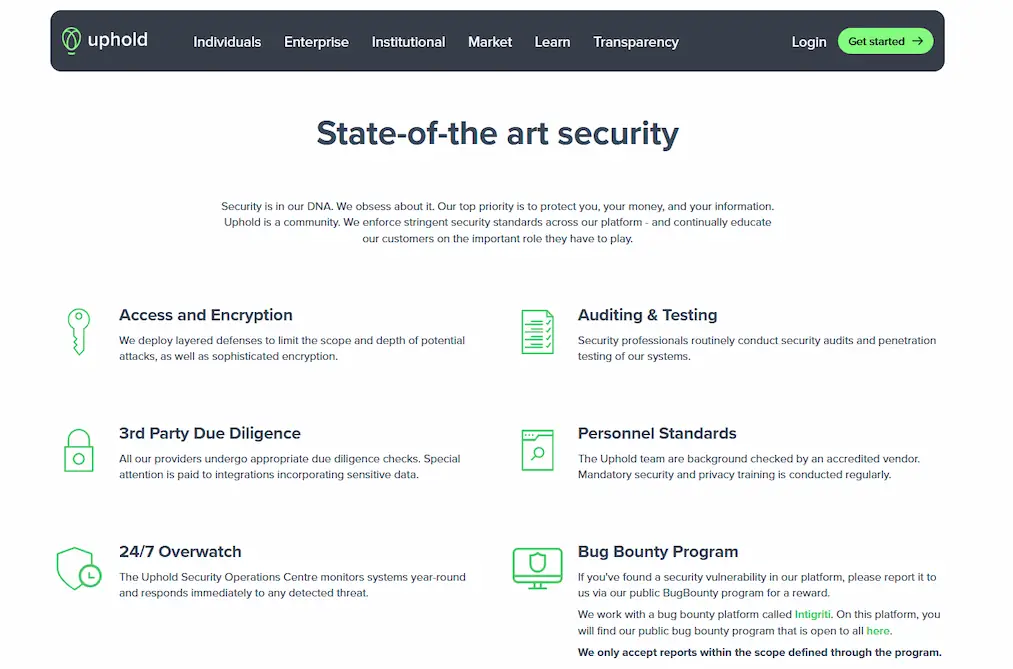

Uphold Security Approach

Regulatory Standing: Regulated in U.S., UK, and European markets Transparency: Real-time reserve reports showing exactly what backs your deposits Storage: Multi-signature wallets, customer funds kept separate Security Features: Two-factor authentication, withdrawal whitelisting

What Users Actually Experience

Reddit gives you the real story on security experiences. jummy006 had this to say:

“I’ve had a slew of issues with CB locking my account for no apparent reason for months on end. Never had a single issue with Uphold though.”

But FadedUON felt differently:

“Personally I trust Coinbase more, but they have also had issues.”

Supported Cryptocurrencies: Coinbase vs Uphold Asset Variety

Coinbase’s Crypto Menu

Total Selection: 400+ cryptocurrencies Their Philosophy: Strict listing requirements, only established projects make the cut What You’ll Find: Bitcoin, Ethereum, major altcoins, select DeFi tokens Staking Options: Available for multiple proof-of-stake coins

Coinbase plays it safe – fewer moonshot opportunities but also less exposure to potential scams.

Uphold’s Crypto Catalog

Total Selection: 300+ cryptocurrencies plus traditional assets Their Philosophy: More aggressive about listing new and emerging tokens Unique Angle: Precious metals, stocks, fiat currencies alongside crypto Early Bird Special: Often first to list controversial or brand-new assets

Why This Matters

Your choice often comes down to what specific assets you want. Reddit user Forward_Ant_9074 made this point:

“Uphold is gonna support RLUSD & very friendly with Ripple team; I don’t think Coinbase will support it.”

This shows how Uphold’s willingness to take risks early can be crucial if you’re interested in specific projects.

User Interface and Mobile Apps: Ease of Use Comparison

Coinbase Design Philosophy

Desktop: Clean, intuitive design with separate basic and advanced interfaces Mobile App: Highly rated (4.4/5 on iOS) with smooth functionality Learning Curve: Almost nothing for beginners, scales up for advanced users

User Reaction: Generally loved for simplicity and reliability

Uphold Interface Reality

Desktop: More complex due to multi-asset nature, can feel overwhelming Mobile App: Gets the job done but some users report performance hiccups Learning Curve: Steeper at first due to their unique “anything-to-anything” approach

G2 reviews confirm that Coinbase wins on ease of use, which makes sense given their focus on user-friendly design.

Customer Support: Real User Experiences and Response Times

Coinbase Support Options

What’s Available:

- 24/7 phone support (for some issues)

- Email support hello@uphold.com

- Live chat (when available)

- Comprehensive FAQ section

Reality Check: Professional but can be slow when markets go crazy

Uphold Support Reality

What You Get:

- Email support only

- Extensive FAQ database

- No live chat or phone support

The Big Problem: No real-time support really frustrates users during urgent situations

Real User Feedback

Reddit user Flaky-Wedding2455 kept it simple:

“I use both. Never had a problem with either.”

But most agree that Coinbase has better customer support infrastructure, even though both get criticized during high-stress market periods.

Final Verdict: Coinbase vs Uphold – Which Should You Choose?

Go with Coinbase if you:

- Care most about security and regulatory compliance

- Want lower fees for active trading (using Advanced)

- Need solid customer support

- Prefer established cryptocurrencies with proven track records

- Want sophisticated trading tools and analytics

Choose Uphold if you:

- Want early access to new crypto projects

- Like transparent, real-time reserve reporting

- Need to trade more than just cryptocurrencies

- Don’t mind paying higher fees for convenience

- Value simplicity over advanced features

The Bottom Line

For most people, Coinbase is probably the better choice because of its security, regulatory compliance, lower fees (on Advanced), and better customer support. Sure, its G2 rating is slightly lower than Uphold’s, but that’s based on way more reviews (121 vs 86), which suggests broader market acceptance.

Uphold serves a specific crowd really well – people who want early access to new tokens, multi-asset trading, and transparent operations. Their higher satisfaction scores show that when you’re their target user, you’re really happy.

Reddit users generally lean toward Coinbase for security and reliability, while acknowledging that Uphold has its place, especially for XRP trading and getting in early on new tokens.

Your decision really comes down to your trading style, how much risk you can handle, and what specific cryptocurrencies interest you. If you’re just starting out, Coinbase’s educational resources and proven track record make it the safer bet. If you’re experienced and looking for specific opportunities, Uphold’s unique features might be worth the extra cost.

Ready to get started? Both platforms make it pretty easy to sign up. Just remember to turn on two-factor authentication and think about getting a hardware wallet for any serious money you’re holding, no matter which platform you pick.