Making a decision about which international money-moving mavens to use often boils down to choosing between Airwallex and Wise. Both of these fintech powerhouses have carved out sizable niches in the cross border payments space, but they address different problems with fundamentally different approaches.

Here’s your complete guide to making the right choice for your multi currency account needs.

- Cross Border Payments: How Airwallex and Wise Stack Up

- Multi Currency Account Features: Airwallex vs Wise Breakdown

- International Money Transfer Costs: Which Platform Saves More?

- Global Payment Solutions: Business vs Personal Use Cases

- User Reviews: What G2 and Reddit Say About Both Platforms

- Cheapest Way to Transfer Money Internationally: The Verdict

- Business Payment Services: Which Platform Wins for Companies?

Cross Border Payments: How Airwallex and Wise Stack Up

Both platforms excel at international transfers, but their approaches differ significantly.

Airwallex (G2 rating: 4.5/5 based on 42 reviews) focuses heavily on business payment solutions with robust marketplace integrations. The platform connects seamlessly with Amazon, eBay, and Shopify, making it ideal for e-commerce businesses handling multiple currencies.

Wise (G2 rating: 3.9/5 based on 89 reviews) takes a more universal approach, serving both individuals and businesses with a mature platform that’s been refined since 2011. Originally known as TransferWise, Wise has built its reputation on transparency and competitive exchange rates.

Key differences in target audiences:

- Airwallex: Online businesses, marketplace sellers, companies needing integrated payment solutions

- Wise: Freelancers, digital nomads, SMEs, frequent travelers, anyone needing straightforward money transfers

Multi Currency Account Features: Airwallex vs Wise Breakdown

Account Coverage and Currency Support

Airwallex offers more extensive local account coverage:

- 21+ currencies across 13 locations

- Major currencies: USD, GBP, AED, AUD, EUR, SGD, HKD, CNY, CAD, CHF, JPY, NZD

- Over 40 currencies supported for transfers to 150+ countries

Wise provides solid but less extensive coverage:

- 9+ currencies with local account details

- Major currencies: USD, GBP, AUD, EUR, SGD, CAD, NZD, PLN, RON

- Over 40 currencies supported for international transfers

Reddit user insight: “Wise is one of the oldest of these fintech banks and thus also one of the most established. So if you’re able to go with them, they’re the least risky of all for sure.” – r/Entrepreneur discussion

Business-Specific Features

Airwallex’s enterprise advantages:

- Dedicated company and employee cards

- Shopping plugins for major e-commerce platforms

- Advanced FX services with spot and forward contracts

- Batch payments to up to 1,000 payees

- 160+ local payment methods via payment links

Wise’s practical benefits:

- “Jars” feature for fund allocation and project management

- Investment opportunities (EEA only)

- Strong API integration capabilities

- Employee cards with ATM withdrawal support

- Cashback features (UK only)

International Money Transfer Costs: Which Platform Saves More?

Fee Structure Comparison

Airwallex Pricing:

- Account opening: Free (most locations)

- Monthly fees: Free

- FX conversion: 0.2% – 1% depending on location

- Receiving local payments: 0.3% fee

- Sending local payments: Free

- SWIFT transfers: SGD 20-35

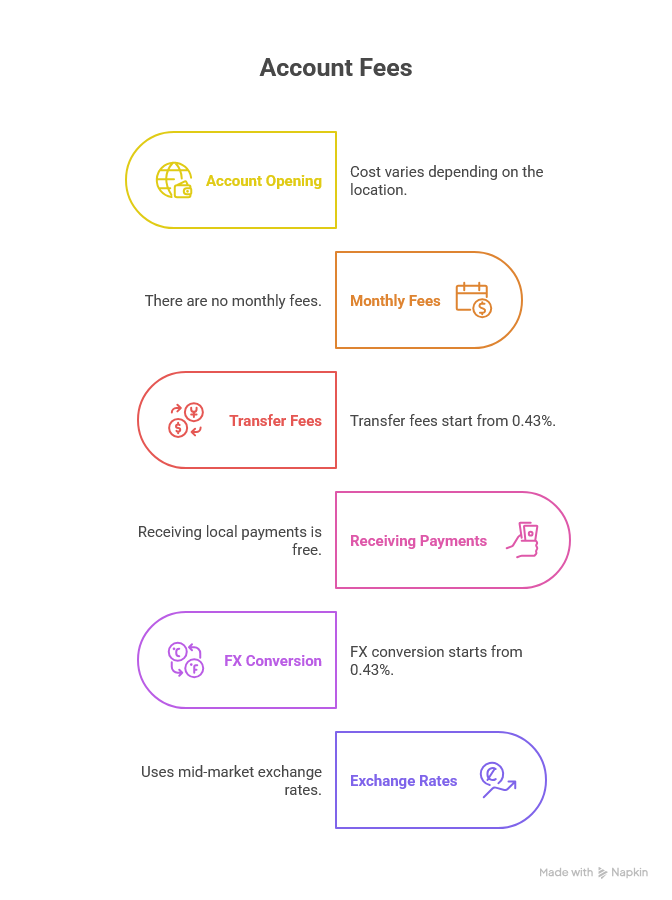

Wise Pricing:

- Account opening: Varies by location (Free in US, £45 in UK, €50 in EEA)

- Monthly fees: Free

- Transfer fees: Starting from 0.43%

- Receiving local payments: Free

- FX conversion: Starting from 0.43%

- Uses mid-market exchange rates

Real Cost Example

For a $10,000 USD to EUR transfer:

- Airwallex: ~$50-100 (0.5-1% conversion fee)

- Wise: ~$43-65 (0.43-0.65% depending on payment method)

User experience: A Reddit user transferring €405,000 for a property purchase reported: “I definitely saved quite a bit of money on the conversion fees… I assume around $USD 6,000” compared to traditional banking. – r/digitalnomad

Global Payment Solutions: Business vs Personal Use Cases

When Airwallex Wins

E-commerce Integration: Airwallex’s marketplace plugins provide seamless integration with major platforms. As one G2 reviewer noted: “The onboarding was smooth, and the user interface is clean and easy to navigate—even for non-finance team members.”

Multi-currency Management: With 8.9/10 rating for multi-currency support on G2, Airwallex excels at handling complex international business operations.

Enterprise Features: Wire transfer capabilities score 9.3/10 on G2, making it ideal for large business transactions.

When Wise Dominates

Reliability: Despite some negative Reddit experiences, most users praise Wise’s consistency. One business user shared: “i’ve used transferwise (now wise) from 2019 to 2023, i’ve sent maybe $100k… never been scammed by them.”

Transparency: Wise’s commitment to mid-market rates and fee transparency has earned strong user loyalty among freelancers and SMEs.

Global Accessibility: Wise operates in more countries and has a longer track record of regulatory compliance.

User Reviews: What G2 and Reddit Say About Both Platforms

G2 Professional Reviews

Airwallex strengths according to G2:

- Multi-currency support: 8.9/10

- Wire transfer capabilities: 9.3/10

- Ease of use: 9.1/10

- Quality of support: 8.5/10

Wise Business strengths:

- More comprehensive review base (89 vs 42 reviews)

- Established user community

- Consistent feature updates

Reddit Community Experiences

Mixed experiences with account holds: Both platforms face criticism for freezing accounts during compliance checks. A Reddit user warned: “Be careful with Wise – they can keep your money without warning” while another Airwallex user reported their “business account shut down in 6 hours. no warning, no explanation.”

Success stories: High-volume users generally report positive experiences. An Aspire user comparing options noted: “Registering and getting approved was so easy, compared to banks that have a ton of red tape.”

Key takeaway: Both platforms implement strict AML (Anti-Money Laundering) procedures that can temporarily affect accounts, but most issues resolve within days to weeks with proper documentation.

Cheapest Way to Transfer Money Internationally: The Verdict

For Small Transfers (Under $5,000)

Winner: Wise

- Lower percentage fees

- No receiving fees for local payments

- Transparent mid-market rates

For Large Business Transfers (Over $50,000)

Winner: Airwallex

- Better rates for high-volume transfers

- No monthly fees

- Advanced FX tools for hedging

For E-commerce Businesses

Winner: Airwallex

- Marketplace integrations save time and reduce errors

- Company/employee card separation

- Payment link functionality

For Freelancers and Digital Nomads

Winner: Wise

- Established reputation

- ATM withdrawal support

- Simple fee structure

Business Payment Services: Which Platform Wins for Companies?

Integration Capabilities

Airwallex’s business focus shines through its extensive integrations:

- Direct marketplace connections (Amazon, eBay, Shopify)

- Accounting software integration (Xero, QuickBooks)

- Payment gateway with 160+ local payment methods

- API access for custom integrations

Wise’s practical approach emphasizes ease of use:

- Strong API for financial management systems

- “Jars” feature for project-based fund allocation

- Employee expense management

- Investment options for idle funds

Scalability Considerations

Growing businesses often prefer Airwallex for its:

- No caps on transaction volumes

- Dedicated account management for high-volume users

- Advanced FX risk management tools

Established SMEs gravitate toward Wise for its:

- Predictable fee structure

- Extensive regulatory compliance

- Proven track record with large transfers

Professional insight: According to Statrys’ analysis, “Fees vary between the two services. Wise might be more cost-effective, but the choice depends on your business requirements.”

Bottom Line: Choose Airwallex if you’re running an e-commerce business that needs marketplace integrations and advanced FX tools. Choose Wise if you need a reliable, transparent platform for straightforward international transfers with strong regulatory backing.