When it comes to deciding the finest method for moving money across countries, two companies regularly crop up in conversations: TorFX and Wise (previously known as TransferWise). Both give the impression of being among those money senders that can be relied on to offer a good deal in terms of the ‘rate’ of exchange, as well as in the price they charge for the privilege of sending your money on its way. But which is genuinely more reliable? Which offers a better deal? Decisions, decisions.

The detailed comparison presented here thoroughly examines real user experiences, G2 ratings, Reddit discussions, and an in-depth analysis of every fee involved to assist you in this decision.

- Best International Money Transfer: Why Choose Between TorFX and Wise?

- Wise Review: Features, Fees, and Real User Experience

- TorFX Review: Personalized Service vs Digital-First Approach

- International Payments: Comparing Fees and Exchange Rates

- Best Way to Transfer Money Internationally: Speed and Reliability

- Send Money Internationally: User Experience and Platform Comparison

- International Money Transfer: Which Service Wins for Your Needs?

Best International Money Transfer: Why Choose Between TorFX and Wise?

The global money transfer sector is jam-packed with competitors, but TorFX and Wise have inched ahead of the competition with their unique business models. Wise dominates the fintech space with its transparent, app-first approach, serving over 16 million customers globally. TorFX takes a more traditional approach, focusing on personal broker relationships and currency risk management tools.

Both companies are fully regulated and have built solid reputations, but they serve different customer profiles and transfer needs.

TorFX vs Wise: Side-by-Side Comparison Table

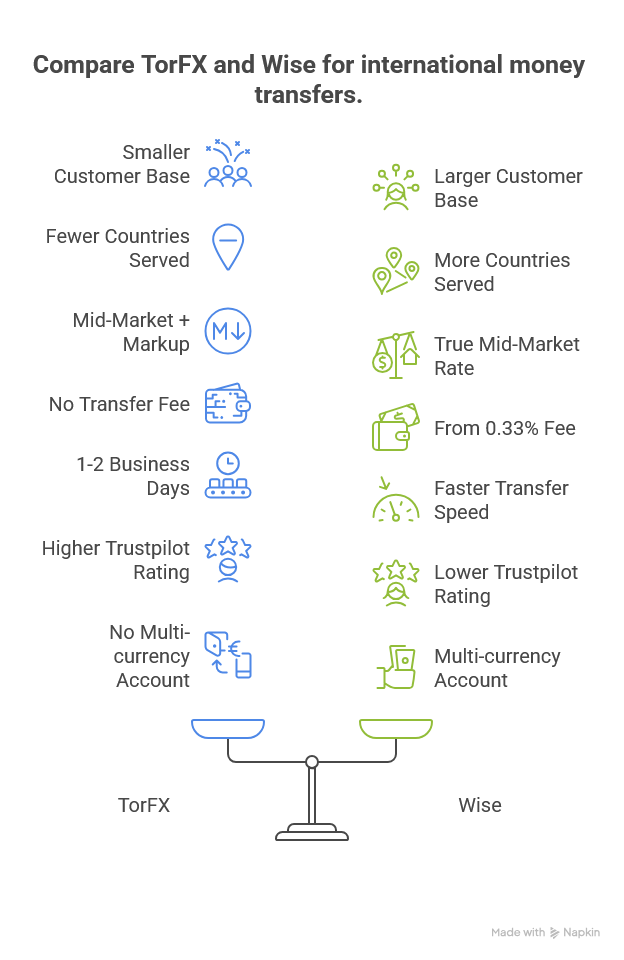

| Feature | TorFX | Wise |

| Founded | 2004 | 2011 (as TransferWise) |

| Customers | 325,000+ | 16+ million |

| Supported Currencies | 40+ currencies | 40+ currencies |

| Countries Served | 40 countries | 160+ countries |

| Exchange Rate | Mid-market + markup | True mid-market rate |

| Transfer Fees | No transfer fee | From 0.33% |

| Speed | 1-2 business days | 60% instant, 90% same day |

| Trustpilot Rating | 4.8/5 (8,479+ reviews) | 4.3/5 (230,000+ reviews) |

| G2 Rating | Not available | 3.9/5 (88 reviews – Business) |

| Multi-currency Account | No | Yes (40+ currencies) |

| Debit Card | No | Yes |

| Dedicated Account Manager | Yes | No |

| Phone Support | 24/7 | Limited |

| Risk Management Tools | Forward contracts, market orders | No |

| Minimum Transfer | £100 | Varies by route |

| Maximum Transfer | No limit | ~1 million GBP equivalent |

Wise Review: Features, Fees, and Real User Experience

G2 Rating: 3.9/5 stars from 88 business reviews

Trustpilot Rating: 4.3/5 stars from 230,000+ reviews

Wise has brought about a major change in how people can send money internationally. The company now uses an easy-to-understand, low-fee structure, which makes international money transfers not only more affordable but also far more transparent. The platform uses the true mid-market exchange rate – the same rate you see on Google – with all fees clearly displayed upfront.

The Good: What Users Love About Wise

“Wise is the most user friendly virtual wallet. It’s so smooth and nice to use. I’ve been with it for 2 years already” – G2 Business reviewer

Reddit user Busy_Ad8650 shared their experience:

“Few years ago I used a newly opened Wise account to send $1m AUD from the UK (sold a property) and it went through without any questions asked. Maybe the fact it came directly from the conveyancer helped.”

The Challenges: Recent User Concerns

Nevertheless, the latest talk on Reddit shows rising discontent. A digital nomad user described their experience:

“I’ve been using TransferWise (or Wise) for a few years now… But I keep having constant issues with them. Most often is that their debit card stops working when you need it, them changing banks, or lately when some ACH payments from my clients in the U.S. were returned for unknown reason.”

The same user received this concerning email from Wise:

“We’ll cancel your Wise cards and suspend your account on August 23. Unfortunately, we weren’t able to verify your residency. This is because it didn’t meet the requirements for a physical address — as a reminder, we can’t accept a PO box or other virtual addresses.”

Multiple Reddit users confirmed similar verification issues, with one noting: “They refuse to give money back I’ve seen so many comments of people having these issues form small amounts like me to very large ones.”

TorFX Review: Personalized Service vs Digital-First Approach

Trustpilot Rating: 4.8/5 stars from 8,479+ reviews

G2 Rating: Not available on G2 platform

TorFX adopts a fundamentally different method, highlighting close connections and phone-based communications. Since its establishment in 2004, it has grown its good name using account managers who offer specialized currency tools.

The TorFX Advantage: Human Touch

Forbes noted in their 2025 review:

“TorFX provided a currency exchange service. It was reliable and trustworthy. They provided a lot of clear information both before, during and after the transaction.”

Reddit user JulieRush-46 shared their positive experience:

“I’ve used them before to transfer a lot of money from the UK to Australia and I had zero issues. Consultant I dealt with was called Katy Lord. She was great. A colleague of mine used them a year or so ago and also was very pleased with them.”

The Drawback: Pricing Transparency

However, one Reddit user who previously worked at TorFX offered this insight:

“I would use transfer wise, source: I used to work at TorFX. Unless they’ve greatly changed their culture in the last X years you’re almost guaranteed a better rate elsewhere.”

This insider perspective highlights a key concern: TorFX doesn’t publish their exchange rates publicly, requiring account creation to see actual costs.

International Payments: Comparing Fees and Exchange Rates

Wise Pricing Structure

- Exchange Rate: True mid-market rate (no markup)

- Fees: From 0.33% + small fixed fee

- Transparency: All costs shown upfront

TorFX Pricing Structure

- Exchange Rate: Mid-market rate + markup

- Fees: No transfer fee

- Transparency: Must register to see rates

Real-World Example: For a $10,000 USD to EUR transfer:

- Wise: You see exactly what you’ll pay before registering

- TorFX: You must create an account and speak to a broker

A Reddit user comparing both services for a £100k transfer noted:

“TorFX seem to be offering a great rate with zero fees. Our other choice is Wise but with no one to contact directly if it goes awry we’re feeling hesitant.”

Their outcome: “UPDATE: we ended up using Wise as it was $900 cheaper and they really didn’t make it sound worth the extra $, and the guy failed to return our phone call!”

Best Way to Transfer Money Internationally: Speed and Reliability

Transfer Speed Comparison

Wise Speed Stats:

- 60% of transfers arrive instantly

- 90% arrive within 24 hours

- Uses local banking networks to avoid international wire delays

TorFX Speed Stats:

- Same day for major currency routes

- 1-2 business days for most transfers

- Traditional SWIFT network for international transfers

Reliability Track Records

Both services maintain strong uptime, but user experiences vary:

Reddit user bericoco reported:

“I used them 2 years ago for a similar amount UK-AUS and it went smoothly. Did a small amount first to test everything was set up right, then the bulk”

Meanwhile, Wise users report increasing verification delays, with one noting: “Their uploads, IT and AI failures along with their poor customer service response, isn’t positive at all.”

Send Money Internationally: User Experience and Platform Comparison

Wise: App-First Experience

- Mobile App: Highly rated for usability

- Web Platform: Clean, intuitive interface

- Account Setup: Fully online verification

- Customer Support: In-app chat, limited phone support

TorFX: Relationship-Focused Service

- Mobile App: Available but limited functionality

- Web Platform: Requires broker interaction for first transfer

- Account Setup: Online registration + phone verification

- Customer Support: 24/7 phone support, dedicated account managers

User Preference: A Reddit user explained their choice:

“TorFX seem to be offering a great rate with zero fees. Our other choice is Wise but with no one to contact directly if it goes awry we’re feeling hesitant. Plus it seems the same cost either way but we get an account manager here in Aus to speak directly to.”

International Money Transfer: Which Service Wins for Your Needs?

Choose Wise If You:

- Value transparency in pricing and fees

- Prefer digital-first solutions with minimal human interaction

- Need a multi-currency account with a debit card

- Make frequent smaller transfers (under $50,000)

- Want the fastest possible transfer times

Choose TorFX If You:

- Prefer talking to humans for financial transactions

- Need currency risk management tools (forward contracts, market orders)

- Transfer large amounts regularly ($50,000+)

- Want a dedicated account manager for ongoing relationship

- Value phone support for complex transactions

Geographic Considerations

For US Users: Wise has broader US banking integration and faster ACH processing.

For UK/EU Users: Both services excel, but TorFX’s FCA regulation provides additional UK-specific protections.

For Australia: TorFX maintains strong local presence with Australian-based account managers.

The Bottom Line

Neither service is universally “better” – the choice depends on your specific needs and preferences. Wise excels at transparency, speed, and digital convenience, while TorFX provides personalized service and sophisticated currency tools.

For most individuals making occasional international transfers under $50,000, Wise’s transparent pricing and speed make it the practical choice. For businesses or individuals making large, regular transfers who value personal relationships and risk management tools, TorFX’s broker-based approach offers distinct advantages.