Wise, the Estonian-born money transfer company based in London, is preparing for major changes. The firm, which went public on the London Stock Exchange in 2021, now plans to adopt a dual listing structure — making New York its primary listing location while keeping London as a secondary venue.

“The U.S. is the largest economy in the world and offers the biggest growth opportunities for us,” Wise explained when announcing the move in June.

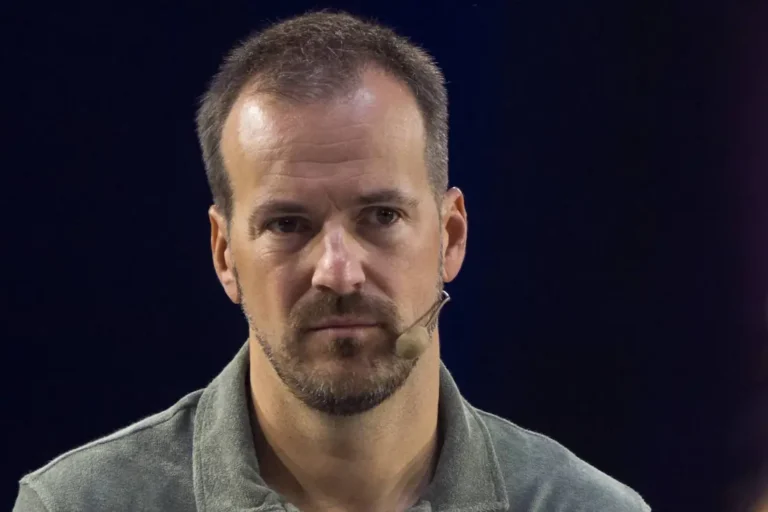

CEO Kristo Käärmann said the decision will help the company grow faster and deliver long-term benefits to both Wise and its shareholders.

As part of the plan, Wise intends to move its legal headquarters to Jersey. It will remain a UK tax resident, but the company hasn’t confirmed whether its main office will stay in London long term.

Wise went public in London through a direct listing in 2021, reaching a valuation of £8 billion (around €9.4 billion at the time). Since then, its stock has gained roughly 5%.

Shareholder Friction Over Voting Rights

The changes were presented to shareholders on July 3 and are due for a vote soon. But not everyone is on board.

Tensions have emerged between Käärmann, who remains active as CEO and director, and co-founder Taavet Hinrikus, who stepped back from the company in 2021.

Hinrikus is not opposed to the dual listing or the move to Jersey. His concern is a proposal hidden in the fine print — a plan to extend the company’s two-class share structure, which gives Class B shareholders (including Käärmann) more voting power.

Originally, these enhanced rights were set to expire in July 2026. Now, shareholders are being asked to extend them by another ten years.

Hinrikus believes this should be a separate decision from the listing change. If not split, he urges shareholders to reject the proposal.

In a statement released through the London Stock Exchange, his investment firm Skala said combining the two proposals “forces shareholders into an unfair compromise” and goes against good governance practices in the UK, where key decisions should be voted on separately. He also noted that Class B rights are usually limited to 5–7 years after a public listing.

The proposal, according to Skala, would weaken the rights of regular Class A shareholders and further concentrate control in the hands of Käärmann.

Board Pushes Back

Wise’s board, led by chairman David Wells, disagrees. They argue that dual-class structures are common in the U.S. and that the extension has backing from both shareholders and independent advisors.

“We’ve had open and constructive talks with Taavet and value everything he’s done for Wise,” the board said in a statement. “We’re disappointed that he chose to take this disagreement public.”

Wise is one of Estonia’s most prominent tech startups. Before founding the company with Käärmann in 2011, Hinrikus worked at Skype as its first employee and strategy chief. The two launched Wise to make international transfers cheaper and easier.

Hinrikus led the company until 2017 and served as chairman until its public listing in 2021. He now works at venture capital firm Plural and focuses on new business ventures.

Through Skala, Hinrikus still holds over 5% of Wise’s total shares and around 15.5% of its Class B shares. Käärmann holds nearly 18% of all shares and more than 40% of Class B shares.